JWC (Jumeirah Village Circle) — Why developers, investors and first-time buyers are watching it in 2025

By Shanu Mathew | Realestate Expert & Chairman | Keepcastle Group of Companies

Article|Nov 9, 2025 at 08:09 Jumeirah Village Circle (commonly known as JVC) has quietly become Dubai’s most in-demand community for affordable family living and investor-friendly returns. Below I unpack: who’s building there, current valuations, population and supply dynamics, lifestyle and rental yields — and a practical affordability + exit plan for someone earning AED 15,000 / month. I finish with how Keepcastle approaches JVC differently by designing the exit first.

Who’s building in JVC — active developers & notable projects

JVC hosts a long list of active developers targeting a wide spectrum of buyers — from budget studios to branded mid-range towers. Major names currently releasing projects or off-plan product in and around JVC include Binghatti, Danube, Ellington, Pantheon, Samana and many smaller niche developers. There are hundreds of off-plan and new projects listed for the community, reflecting continued developer interest.

Notable recent / upcoming project types: mid-rise apartment towers, lifestyle complexes with retail, and townhouse/villa pockets (Nakheel’s original masterplan). Expect frequent off-plan launches and periodic branded launches over the next 2–4 years.

Valuation snapshot (what properties cost today)

Price per sq.ft. in JVC sits in the mid-range for Dubai — many market trackers show ~AED 1,400–1,650 / sq.ft. for apartments in 2024–25, with variations by tower, finish and handover status. Using local market listings, a typical 1-bed (≈650–750 sq.ft.) commonly lists in the AED 650k–1.2M band depending on developer and fit-out. Resale & off-plan pricing trends are still rising in 2025 as demand outpaces attractive ready inventory.

Population & demand signals

Estimates for residents vary by source and date — JVC has matured rapidly from a few thousand residents a decade ago to a community that market guides now commonly place in the tens of thousands (some sources cite 25k+, while market overviews highlighting user interest/pageviews put demand far higher month-to-month). In short: population & renter demand are no longer negligible — JVC is a dense, family-oriented neighbourhood with strong tenant appetite.

Rental yields & investor case

JVC regularly features among Dubai’s top communities for rental yields. Benchmarks in 2024–2025 put apartment yields in the ~6.5–8% range depending on unit type and management — studios and one-beds typically deliver the highest % returns. That makes JVC attractive to buy-to-let investors who can balance modest purchase prices with reliable tenant demand.

Community lifestyle — why people choose JVC

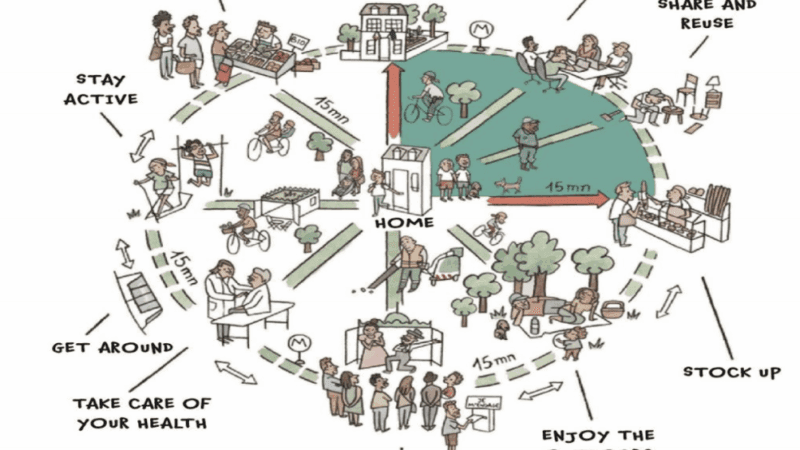

Family friendly: parks, nurseries, a growing list of schools and sport facilities.

Connectivity: fast road links (Al Khail, Sheikh Mohammed bin Zayed) to Dubai Marina, Business Bay, and airports.

Diverse stock: apartments, townhouses and villa clusters to suit families and young professionals.

Everyday convenience: retail, supermarkets, clinics and cafes inside the community make it self-contained.

Is JVC affordable for someone earning AED 15,000 / month?

Short answer: Yes — with planning and realistic expectations. Here’s a worked example (assumptions stated clearly):

Assumptions

Typical 1-bed size: 700 sq.ft.

Market price estimate: AED 1,496 / sq.ft. (market list average) → property price ≈ AED 1,047,200.

Down payment: 20% → AED 209,440.

Mortgage = AED 837,760.

Example mortgage terms: 5.0% p.a., 25 years → monthly repayment ≈ AED 4,900 (calculated using standard amortisation formula). (illustrative figure — actual rate & term will vary by lender and borrower profile).

Other monthly housing costs to budget:

Service charges & maintenance: AED 800–2,000

Utilities & insurance: AED 300–700

Estimated monthly housing outflow (mortgage + charges): ~AED 6,000–7,600, which is roughly 40–50% of gross income (AED 15k). That is workable if the borrower has a healthy buffer, low other debt, and a steady employment profile. Options to increase affordability:

larger down payment to reduce EMI;

buy smaller unit (studio) or buy off-plan at earlier pricing;

use rental income (if buying as an investment) to service mortgage partially;

consider 2-income household or family help for the down payment.

(All figures are illustrative. Speak with banks for pre-approval and up-to-date mortgage pricing.)

Future valuation & exit strategy (practical roadmap)

Short/Medium horizon (3–5 years): expect capital appreciation supported by Dubai’s broader housing rally, continued population growth, and JVC’s high rental demand. However, Dubai cycles can be volatile — so plan an exit, not hope for one.

A pragmatic exit plan:

1. Define target IRR / price point up front. (e.g., 12–20% over 3–5 years).

2. Select product to match buyer-type: short-term flip → pick studios/1-beds with low holding costs; longer hold for rental yield → pick 1–2 beds with stable rents.

3. Value-add: choose units where minor upgrades (kitchen/bath) or staging will materially raise resale appeal.

4. Stagger liquidity: keep one asset on rental, one as sale candidate — avoid selling everything in a single market window.

5. Market timing & channels: target end-users and regional buyers (UAE expats, GCC investors) rather than purely speculators — this improves sale speed and pricing.

How Keepcastle approaches JWC differently

At Keepcastle we start with the exit: acquisitions and developments are structured around a clear, investor-oriented exit blueprint (who will buy, at what price, value-add plan, and a contingency). That means:

acquisition criteria include resale demand mapping, not just build cost;

we prepare investor-ready pitch packs and staged refurbishment budgets before purchase;

we build a shortlist of buyer segments and ready channels (end-users, investors, funds) so exits are executable, not hopeful.