What “De-dollarization by 2030” Means

By Brutnow Team | Brutnow Media Company | Global Businesses

Article | 6, 2025 at 21:28 “De-dollarization” refers to the gradual reduction in the dominance of the U.S. dollar in global trade, reserves, and financial systems, and the rise of alternatives (other fiat currencies, gold, digital assets, regional currency blocs, etc.).

By 2030, this could imply:

- The share of U.S. dollar reserves held by central banks falling significantly (some forecasts suggest from ~40-45% down toward 30-50 %)

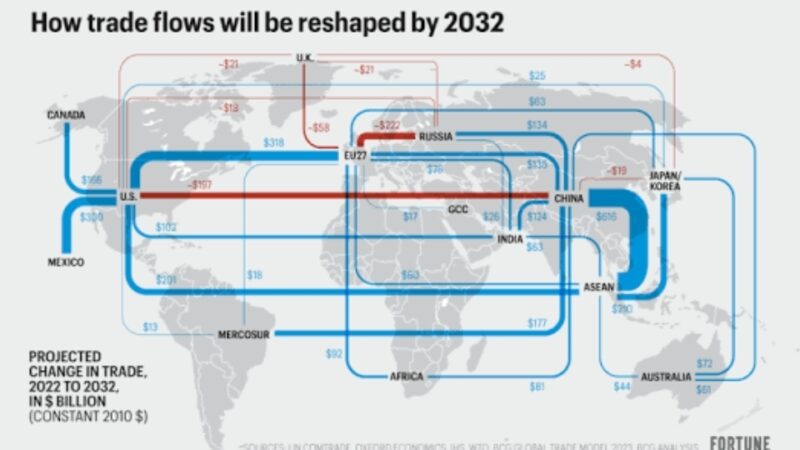

- Greater use of local or regional currencies in trade invoicing and settlement, particularly among emerging markets and in trade blocs (e.g. intra-Africa, BRICS, Latin America)

- Financial fragmentation and segmented currency systems, rather than a monolithic dollar-centric order

- A shift in the reserve asset mix: increased allocations to gold, digital assets (e.g. Bitcoin), or other non-dollar instruments

- Challenges for U.S. fiscal financing: if demand for U.S. treasuries weakens, borrowing costs could rise and the U.S. could face pressure on its external balance and monetary authority credibility

However, it’s not expected to be a sudden collapse of dollar supremacy. Most forecasters expect a gradual rebalancing over the decade, rather than a sudden shock.

Recent Signals / News Trends (2025)

These developments hint at how de-dollarization is unfolding in real time:

- Declining U.S. Treasury holdings by foreign central banks: The custody of foreign central bank Treasuries held at the New York Fed recently dipped to ~$2.78 trillion, its lowest since 2012, raising warnings about reduced global appetite for U.S. debt.

- Major banks exploring stablecoins pegged to G7 currencies: A consortium including Bank of America, Deutsche Bank, UBS, Citi, and others are investigating issuance of stablecoins pegged to G7 fiat currencies, perhaps signaling a hybrid pathway combining digital rails with traditional currencies.

- COMESA (African trade bloc) launching local-currency digital payments system: To bypass U.S. dollar conversions in cross-border trade, COMESA is rolling out a digital retail payments infrastructure for settlement in member states’ currencies.

- China doubling down on its digital yuan (e-CNY): The People’s Bank of China is pushing global use of e-CNY, with plans for an international operations center and cross-border settlement systems (CIPS) to reduce reliance on the dollar in trade.

- Central banks eyeing Bitcoin and gold allocations: Reports (e.g., from Deutsche Bank analysts) suggest that by 2030, central banks may treat Bitcoin (and gold) as a “cornerstone” reserve alongside traditional assets.

These signs suggest that de-dollarization is not just theoretical: new payment systems, policy shifts, and reserve portfolio experiments are already in motion.

Implications for Global Markets

Here are several ways the trend could impact financial markets, geopolitics, and investment strategies:

| Area | Potential Impact |

|---|---|

| U.S. Sovereign and Credit Risk | Lower foreign demand for Treasuries may push U.S. yields higher, increasing cost of capital and refinancing risk for the U.S. government. |

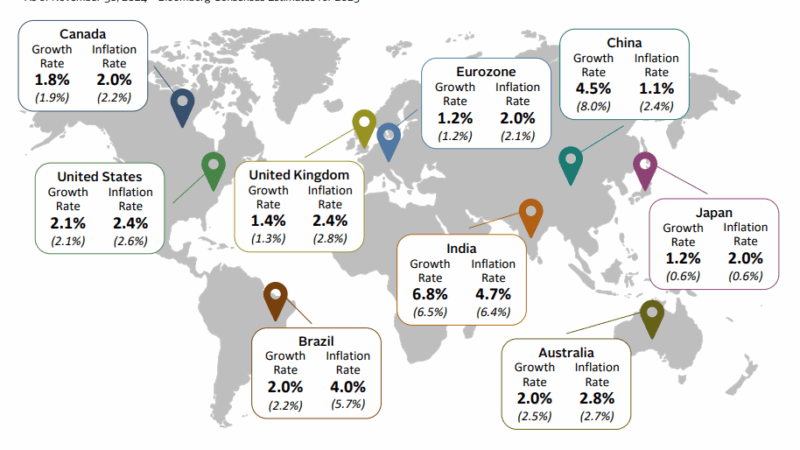

| Exchange Rates & Currency Volatility | The dollar could weaken vs. other major currencies, especially if confidence erodes. Emerging market currencies could benefit in regional blocs. |

| Capital Flows & Emerging Markets | Capital may flow toward non-U.S. markets, especially those with alternative currency systems or strong domestic demand. |

| Fragmentation & Regional Blocs | We may see more regional monetary blocs (e.g. African currency zones, BRICS arrangements) with their own settlement systems. |

| Commodity / Energy Markets | Oil and gas trade may shift away from dollar invoicing, especially between non-U.S. trading partners, altering petrodollar dynamics. |

| Risk / Safe Havens | Gold may regain a stronger role as a universal safe asset; sovereign credit spreads may widen for weaker economies. |

| Financial Intermediation Disruption | Banks, FX systems, and broker-dealers may need to adapt to multi-rail, multi-currency settlement frameworks and digital rails. |

It’s worth noting that the transition is unlikely to be smooth or linear. Political volatility, policy missteps, or external shocks (e.g. geopolitical conflicts) could accelerate or derail the process.

Implications & Opportunities in Digital Currencies

Digital currencies (including stablecoins, CBDCs, and crypto assets) are central actors in any de-dollarization shift. Here’s how they factor in:

1. CBDCs (Central Bank Digital Currencies)

- Widespread adoption of CBDCs could strengthen the position of alternative currencies (e.g., the digital yuan) by making cross-border settlement smoother and cheaper.

- A BIS survey suggests there might be ~15 retail CBDCs in circulation by 2030.

- InterCBDC bridges (e.g. mBridge, involving the UAE, China, Hong Kong, etc.) are being developed to facilitate cross-border CBDC exchange.

2. Stablecoins

- Stablecoins pegged to major currencies currently reinforce the dollar’s role, but the space may evolve to include non-USD stablecoins (e.g. euro-stable, yuan-stable, commodity-backed)

- The interplay between stablecoins and de-dollarization is complex: some see them as tools preserving dollar dominance (by making dollar use more efficient), while others see them as bridges toward new monetary regimes.

3. Bitcoin & Decentralized Crypto Assets

- Bitcoin is increasingly viewed as a digital “hard asset” or reserve alternative, especially in scenarios where trust in fiat weakens.

- Some analysts predict central banks will hold Bitcoin as part of reserve portfolios by 2030.

- However, volatility, regulatory uncertainty, and scalability remain key challenges.

4. New Digital Reserve Models

- Some speculative academic proposals exist (e.g. quantum-backed tokens) as potential new global reserve mechanisms, though they are far from practical deployment.

Risks, Constraints & Uncertainties

While the momentum is evident, a few key constraints may slow or complicate de-dollarization:

- Dollar inertia & network effects: The dollar benefits from decades of entrenched use in trade, finance, contracts, and reserve holdings — it’s not easy to dislodge.

- Liquidity & depth: U.S. capital markets are deep, liquid, and trusted; alternatives must match these attributes to rival the dollar’s appeal.

- Regulatory / political backlash: The U.S. and allied economies may respond defensively (e.g. financial sanctions, regulatory crackdowns on digital assets) to preserve dollar dominance.

- Coordination and trust challenges: For regional or alternative currency systems to scale, multilateral coordination and trust (among central banks, regulators, and markets) are crucial.

- Technical, infrastructure, interoperability challenges: Moving to digital rails, cross-chain settlement, multi-CBDC architectures, and secure infrastructure is nontrivial.

- Volatility & confidence risk: If alternative assets (e.g. Bitcoin) experience major crashes, confidence in them as reserve-worthy instruments could erode.

Bottom Line & What to Watch

- De-dollarization by 2030 is not guaranteed, but the direction seems set: gradual erosion of exclusive dollar dominance, rise of multiple currencies, and increased role for digital monetary systems.

- The biggest inflection point will be when central actors (central banks, sovereign wealth funds) meaningfully diversify away from U.S. treasuries into alternative assets (gold, digital assets, alternative currencies).

- In the digital currency space, the winners will be those systems (CBDCs, stablecoins, crypto) that combine trust, interoperability, liquidity, regulatory compliance, and scalability.

- For investors and policymakers, this era demands vigilance: currency risk hedging, portfolio resilience, staying abreast of digital infrastructure, and anticipating regime shifts.